This is a case study reviewing reimbursement tactics by two managed care payers. This case study reviews actual data from a mid-Atlantic hospital treating 45,000 emergency department visits annually.

While we felt we were negotiating successfully with two managed care companies because we were able to receive a 5 percent increase in calendar year 2014, we were concerned that our overall payment did not reflect the expected increase. Due to this concern we performed a rigorous examination of the payer behavior particularly as it related to shifting additional responsibility to patients in the form of deductibles, co pays and co insurance.

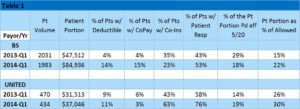

Table 1 presents the relevant data from the first quarter of 2013 and the first quarter of 2014. The patient volumes are almost identical. However, the patient portion increases over the two years, particularly in the case of Blue Shield. Perhaps most noteworthy is how deductibles, co pays and co insurance increase over these two years. When looking at the overall increase in percent of patients with patient responsibility we noticed an increase from 43% to 53% on the Blue Shield products and an increase from 58% to 76% on the United products. As most of us are aware our success in collecting patient portion is dramatically less than receiving insurance payment. As you can see the percent of the patient portion collected by May 20 in each of the two years is roughly 20 percent.

After reviewing the data behind our claims submitted to Blue Shield and United with the respective remittance advices and explanation of benefits, we identified a significant trend in shifting payment responsibility to the patient. In the case of Blue Shield in this case study the dramatic shift occurred in the percent of patients with a deductible and a co pay. In the case of United the shift occurred most dramatically in the percent of patients with co insurance.

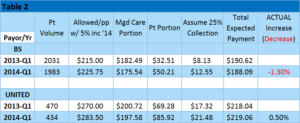

Translating this into expected payment.

In the case of Blue Shield the 5 percent increase allowed an overall payment of $225.75 in 2014 (see Table 2). Unfortunately due to the low collection rate on the patient portion the actual payment for 2014 has been less than actual payment in 2013 ($188.09 compared to $190.62). In the case of United the 5 percent increase allowed a payment of $283.50. However, with the additional payment shifted to the patient portion the actual expected payment came out to $219.06 compared to the 2013 level of $218.04. So, in the case of Blue Shield what we thought was a negotiated 5 percent increase ultimately resulted in a 1.3 percent decrease in total expected payments. In the case of United the 5 percent increase resulted in a .5 percent increase in expected payments.

Summary: Payers have been aggressively shifting payment responsibility to patients. This is seen in deductible increase, co pay increase and co insurance increase. In our example with Blue Shield and United what we thought was an impressive 2014 increase of 5 percent on negotiated reimbursement, ultimately resulted in a 1.3 percent decrease in collections with Blue Shield and .5 percent increase for United. In order to be successful in the Affordable Care Act era, find and work closely with a partner capable of “getting in the weeds” to fully dissect and understand all aspects of your managed care reimbursement. Only with this granular analysis will you be able to successfully negotiate in a sustainable manner with managed care payers.